To create an insurance policy, start by identifying the type of coverage needed, such as health, auto, or home insurance. Research & compare different insurers to find suitable options. Gather necessary information like personal details, asset values, & risk factors. Draft the policy by outlining coverage terms, exclusions, limits, & premium costs. Ensure compliance with legal requirements & include clear definitions. Review the policy for accuracy, then seek a licensed agent’s assistance for finalization & approval. Regularly revisit the policy to adjust coverage as circumstances change.

How to Create an Insurance Policy: A Step-by-Step Guide for Beginners. Learn how to create an insurance policy easily! This simple, step-by-step guide for beginners breaks it down so anyone can understand. Start today!

Understanding Insurance Policies

Creating an insurance policy can seem daunting, but breaking down steps will make this manageable. Familiarizing oneself with various insurance types available provides a solid foundation. Policies can range from health & life insurance to property & auto insurance, catering to diverse needs.

Each type of policy serves specific purposes, ensuring that individuals & businesses have coverage suitable for their situation. Understanding coverage terms, limits, & exclusions plays an essential role when crafting an insurance policy. Knowledge gained over time will aid in making informed decisions.

Having experienced developing a personal insurance policy, I realized how crucial comprehension of specifics became during this process. Diving deep into terms, definitions, & requirements offered clarity necessary for creating a solid policy.

Identifying Your Insurance Needs

Before one can draft an insurance policy, identifying personal or business needs proves vital. Assessing risks associated with one’s life, assets, or business operations will guide selection process. Understanding these risks enables crafting appropriate coverage, ensuring adequate protection.

In assessing insurance needs, consider factors such as age, health status, lifestyle, & financial obligations. For businesses, factors like industry type, workforce size, & operational risks should also come into play. After evaluating these factors, one can begin determining necessary coverage amounts.

Utilizing tools like insurance calculators or consulting with professionals helps fine-tune needs assessment. Establishing a clear picture of requirements sets a strong groundwork for creating an effective insurance policy. Gathering all relevant information maximizes benefits from subsequent steps in policy creation.

Choosing Insurance Type

After assessing needs, selecting appropriate insurance type becomes crucial. Various categories exist, including life, health, auto, homeowner’s, & business insurance. Each type addresses distinct circumstances & requirements.

Life insurance offers financial security for dependents, providing peace of mind for individuals concerned about loved ones’ future. Health insurance ensures coverage for medical expenses, safeguarding against unexpected health-related costs. Homeowner’s insurance protects one’s property against possible damages or losses.

For businesses, commercial insurance options assist in mitigating risks associated with operations, employees, & customers. Researching multiple options helps individuals make informed decisions regarding levels of necessary coverage & policy features. This stage also allows one to compare premiums, benefits, & limitations across various providers.

Researching Insurance Providers

Finding a reputable insurance provider forms another fundamental step in creating a policy. Researching available companies lets individuals gauge their ratings, customer reviews, & overall trustworthiness. A direct approach includes checking industry rankings & financial strength assessments.

Engaging with existing customers through forums or discussion platforms offers insights into experiences with particular companies. Direct communication with insurers through customer service can also illuminate aspects of operation that may not be readily available online.

Comparing multiple providers based on coverage options, pricing, & available customer service ensures selection of a provider matching individual requirements. Taking time during this research phase ultimately saves individuals from potential issues arising from inadequate coverage conditions.

Gather Necessary Information

Before initiating policy creation, gathering all essential information remains imperative. This includes personal details, asset evaluations, & risk assessment results. Having accurate information readily available streamlines process & minimizes potential errors.

For personal insurance, necessary information typically involves age, medical history, & financial details. In terms of assets, knowing property values or outstanding loans will aid in determining coverage amounts. For business insurance, information about employees, operations, & property ownership should be collected as well.

Filing all gathered documentation in an easily accessible format allows for seamless navigation once policy creation begins. Ensuring all necessary details are accounted for will contribute significantly toward a well-prepared policy, aligning with individual or business needs.

Understanding Policy Terms & Conditions

As one embarks on crafting an insurance policy, comprehending terms & conditions becomes pivotal. Every policy comes with specific language that may seem confusing at first glance. Familiarizing oneself with common terms such as premiums, deductibles, limits, & exclusions is essential for navigating this sector.

Premium refers to payment made for policy coverage, while deductible signifies amount paid out-of-pocket before insurance activates. Policy limits denote maximum payout insurers will cover, & exclusions indicate situations not covered under the policy. Grasping these terms assists individuals in making informed decisions based on available options.

Reading through sample policies or industry literature enhances understanding of what certain terms imply. Engaging with insurance professionals can also clarify uncertainties that may arise. Taking time during this phase ensures one feels prepared heading into final policy creation.

Selecting Coverage Amounts

Upon understanding terms, selecting appropriate coverage amounts becomes paramount. Factors influencing coverage amounts include individual lifestyle, asset values, risk exposure, & financial obligations. Whether optimizing personal or business insurance, finding an ideal balance promotes adequate protection.

For personal policies, assessing liabilities along with income levels heightens awareness about necessary coverage limits. Businesses should scrutinize potential risks, evaluating prospect for liability claims against available assets. Understanding what amount equates to sufficient coverage helps avoid under-insurance or over-insurance situations.

Consulting with insurance professionals or utilizing online calculators streamlines this process, guiding individuals through selecting appropriate coverage amounts tailored toward specific circumstances. Taking into account unique attributes allows crafting a policy that adequately protects individuals & businesses.

Seeking Professional Guidance

Engaging with an insurance professional offers insights that simplify policy creation. These advocates not only possess vast knowledge about various products but can also help tailor policies based on individual needs. Their experience becomes invaluable, especially for beginners navigating complexities in insurance.

Consultants can clarify confusion surrounding terms, assist with thorough needs assessments, & provide access to additional resources. By building a rapport, individuals can feel more confident in their choices, ultimately leading to comprehensive coverage that aligns with their requirements.

Utilizing experts increases chances of developing high-quality, personalized insurance policies while mitigating pitfalls that may arise from uninformed decisions. Seeking professional guidance fortifies confidence during policy creation phase, paving way for successful outcomes.

Reviewing & Finalizing Your Policy

Reviewing entire policy before finalization ensures nothing has been overlooked. This phase offers opportunity for individuals to thoroughly assess every detail, confirming alignment with initial goals & preferences. Ensuring clarity within terms will help avoid misunderstandings down line.

During review, individuals should focus on coverage amounts, premium rates, & all specific terms. Conducting comparisons among other potential policies can also facilitate understanding whether selected policy meets expectations & requirements adequately. Seeking input from trusted family or friends may provide additional perspectives.

Once satisfaction with policy details has been confirmed, moving forward into finalization becomes seamless. Ensuring proper documentation has been signed, reviewed, & recorded maintains auspicious framework for successful operation moving forward into protection cycle.

Understanding Premiums & Payment Options

Understanding premiums remains essential after finalizing a policy. Premiums can fluctuate based on coverage amounts selected & specific insurer policies. Learning how premiums are calculated assists individuals in managing overall budgets while addressing potential adjustments needed down line.

Methods of payment also vary, with options commonly spanning monthly, quarterly, or yearly installments. Selecting an appropriate payment plan can have significant impacts on financial obligations & cash flow. Researching advantages associated with models will aid individuals in making a well-informed choice about payment strategies.

Overall, understanding how premiums work, in tandem with payment options available, enhances individuals’ abilities to negotiate terms, securing the best possible arrangement. This knowledge fosters better alignment between financial considerations & necessary coverage.

Monitoring Your Policy

Once an insurance policy has been created, continuous monitoring becomes paramount. Changes in lifestyle circumstances, asset values, & overall financial situations should prompt regular policy reviews. This ensures that coverage remains adequate & aligned with evolving needs.

Engaging with insurance providers during these reviews assists in understanding any necessary adjustments based on life changes or emerging risks. As market conditions fluctuate, reassessing coverage can highlight areas requiring modification, thereby maintaining an optimal level of protection.

Being proactive in observing policy details guards against potential lapses in coverage, which can introduce vulnerabilities. Staying informed regarding industry’s latest trends strengthens policy effectiveness & supports resilience through ongoing assessment & adaptation.

Tips for Creating an Insurance Policy

- Evaluate personal needs thoroughly.

- Consider multiple insurance types for adequate coverage.

- Research various providers before settling on one.

- Gather necessary documentation for clarity.

- Understand common policy terms & definitions.

- Assess appropriate coverage amounts based on circumstances.

- Consult with a professional for guidance.

Key Factors to Consider While Creating an Insurance Policy

- Identify assets needing protection.

- Account for potential risks associated with personal/business factors.

- Ensure clarity on policy exclusions & limitations.

- Assess personal financial situation carefully.

- Stay updated on insurance industry trends & regulations.

- Review policy documentation regularly for necessary modifications.

- Engage with customer service for questions regarding your policy.

Document Checklist for Insurance Policy Creation

- Personal identification documents (ID, SSN).

- Financial documentation (bank statements, tax returns).

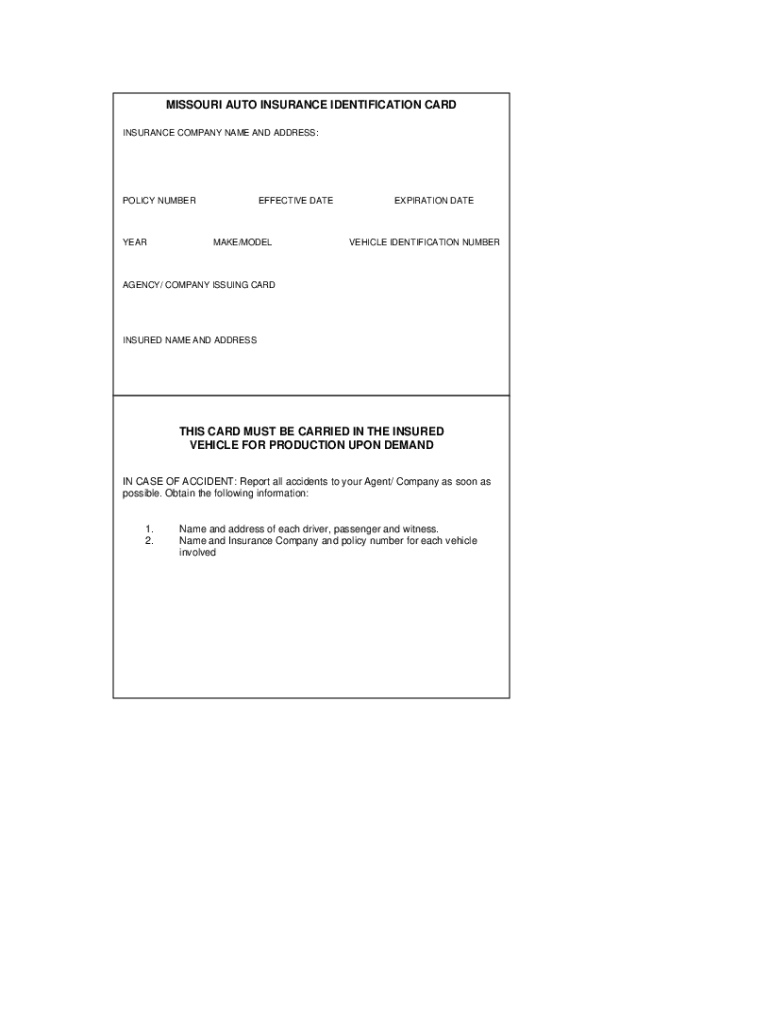

- Asset documentation (property deeds, vehicle registrations).

- Medical records (if applicable for health/life insurance).

- Business documentation (if applicable licenses, employee records).

- Existing insurance details (if applicable).

- Any relevant contracts or agreements.

Table of Common Insurance Terms

| Term | Definition |

|---|---|

| Premium | Amount paid for policy coverage. |

| Deductible | Out-of-pocket expense before insurance pays. |

| Exclusions | Situations or circumstances not covered. |

| Policy Limit | Maximum payout offered by insurer under certain conditions. |

Understanding Policy Exclusions & Limitations

Exclusions within an insurance policy identify situations where coverage does not apply. Familiarizing oneself with exclusions proves crucial in ensuring understanding surrounding limitations existing within a policy. Common exclusions may encompass acts of nature, pre-existing conditions, or specific high-risk activities.

Being aware of these exclusions aids in managing expectations when filing claims & secures individuals from potential financial burdens stemming from uncovered situations. Reviewing policy documentation aligns with understanding how these exclusions impact particular coverage.

Considering limitations also plays an instrumental role in crafting relevant policies. Analyzing limited coverage scenarios helps individuals determine if supplementary policies or additional riders might be necessary. Overall, awareness ensures preparedness when handling unforeseen circumstances.

Table of Payment Options

| Payment Frequency | Pros | Cons |

|---|---|---|

| Monthly | Lower immediate out-of-pocket expense | May incur additional fees |

| Quarterly | Balanced approach for budgeting | May not provide maximum savings |

| Annually | Often cheaper overall | High upfront cost |

“Investing time in understanding each aspect of your insurance policy leads to wise choices that can protect you in challenging times.”

Final Thoughts on Creating an Insurance Policy

Embarking on a journey toward creating an insurance policy requires informed decision-making, thorough research, & attention to detail. Embracing each step provides clarity & confidence, leading one through complexities typically faced in this sector. Building a solid foundation while remaining adaptable prepares individuals for future challenges that may arise.

Ultimately, investing time into education surrounding insurance policies ensures individuals feel both prepared & capable of making well-informed choices moving forward. The benefits of having a well-structured policy translate into enhanced security & peace of mind, allowing one to navigate life’s uncertainties with assurance.

Conclusion

Creating an insurance policy doesn’t have to be overwhelming. By following our simple step-by-step guide, you can easily understand each part of the process. Start by identifying your needs & selecting the right coverage. Don’t forget to compare quotes & read the fine print. Tailoring your policy ensures that you’re protected against unforeseen events. Always keep your information up to date & review your insurance regularly. With these tips, you can confidently navigate the world of insurance policies & make the best choices for your future. Happy planning!