Insurance premiums primarily cover claims made by policyholders, allowing companies to reimburse losses. A significant portion also goes towards administrative costs, including marketing, claims processing, & employee salaries. Insurers set aside funds for reserves to ensure they can pay future claims & manage risks. And another thing, premiums contribute to profit margins for the company, which supports growth & development. Investing in reinsurance helps protect against large losses, further influencing how premiums are allocated. Overall, insurance premiums ensure financial stability & claim payouts while covering operational expenses.

Where Do Insurance Premiums Go? Understanding Your Insurance Costs. Curious about where **insurance premiums** go? Learn how **insurance costs** work & what affects your rates in a straightforward guide.

Understanding Insurance Premiums: An Overview

Every year, millions pay insurance premiums without entirely grasping how these funds are allocated. As someone who navigated through several insurance policies, I can attest that understanding where premiums go significantly impacts how individuals approach their coverage needs. Learning about premiums reveals a complex system involving risk assessment & distribution of costs among various stakeholders in an insurance company.

Components of Insurance Premiums

Insurance premiums consist of multiple elements contributing to overall costs. They can include administrative expenses, claim payouts, & reserves for future claims. Insurers assess many factors when calculating premiums, such as customer demographics, type of coverage, & geographical location. Each component plays a crucial role in determining how much a policyholder pays.

For example, young drivers often face higher premiums due to statistics indicating less experience. Conversely, older drivers typically enjoy lower rates since they demonstrate safer driving habits. Understanding these differences can lead individuals to make informed decisions regarding their insurance needs.

And another thing, insurance companies employ actuaries who use statistical models to forecast potential claims. By evaluating historical data, these professionals estimate future risks helping companies set premiums appropriately. Each of these interconnected parts contributes directly to how premiums are structured within various policies.

Administration & Overhead Costs

Administrative costs encompass expenses related to operating insurance companies, including salaries, office supplies, technology, & marketing strategies. Companies need efficient administration systems to handle policy management, customer support, & overall operations. These expenses are factored into premium calculations, ensuring insurers cover essential operational costs.

On top of that, as technology evolves, many insurers invest heavily in software solutions for streamlining claims processing & improving customer service. These developments can enhance user experience but contribute further to **premium** costs. While customers may not see a direct connection, these expenses ultimately impact their monthly or annual premiums.

Each of these operating costs adds up. Therefore, understanding where **insurance premiums** go requires analyzing both direct & indirect expenses associated with maintaining an insurance company. Recognizing this helps consumers grasp why some policies carry higher **costs** than others.

Risk Assessment & Underwriting

Another significant component of premiums involves assessing risk & underwriting. Insurance companies determine risk levels by evaluating specific characteristics of potential policyholders, such as their claims history, financial stability, & personal factors. Higher-risk individuals typically face steeper premiums as insurance for them carries greater financial risks for the company.

Underwriting serves as a detailed assessment process that analyzes various risk factors before deciding on policy approval. During this stage, insurers might request additional information through questionnaires or require medical examinations for health insurance applicants. This thorough evaluation ensures that **premium** calculations reflect an accurate representation of the underlying risks associated with each policyholder.

Understanding underwriting factors helps policyholders identify opportunities for lowering their premiums, such as improving credit ratings or maintaining a clean claims history. By actively managing individual risk profiles, they can significantly influence their **insurance** costs over time.

Claims Payouts

Claims payouts represent one of the largest expenditures for insurers. When policyholders file claims, insurance companies assess their validity, evaluating whether claims qualify under agreed-upon circumstances. Efficient claims processing contributes to customer satisfaction yet exerts pressure on profits, ultimately affecting premium pricing.

Insurers calculate long-term profitability by estimating claims-related costs based on data trends & actuarial analyses. This forecasting helps insurance companies make informed decisions about **premium** adjustments, ensuring they maintain sufficient funds for potential payouts. As a result, fluctuations in claims activity can significantly impact overall premiums.

Understanding these dynamics clarifies why certain events, such as natural disasters, can lead to abrupt increases in premiums across various regions. Payouts related to extensive claims during catastrophic events underscore how interconnected all aspects of **insurance premiums** are, influencing each policyholder’s experiences.

Factors Influencing Insurance Premiums

Numerous elements impact insurance premium calculations. Whether personal or external, these factors can lead to significant fluctuations in **costs** depending on individual circumstances. Understanding these elements empowers policyholders when evaluating options & seeking better rates.

Personal Factors

Personal factors play a crucial role in determining insurance premiums. Aspects like age, gender, marital status, & occupation can all influence pricing structures. For instance, younger drivers usually face higher premiums due to statistically increased risk of accidents. Likewise, individuals working in high-risk professions may experience higher coverage costs.

Aside from basic demographics, insurers also evaluate driving records, credit scores, & previous claims history. Safe drivers & those with a strong credit rating typically receive lower premiums as they signify reduced risk potential. Active engagement in improving personal factors can result in considerable savings on **insurance costs** over time.

Understanding how personal circumstances affect premiums allows individuals to take proactive steps towards reducing their overall expenses while still acquiring adequate coverage. This knowledge empowers consumers regarding their rights during negotiations with insurance providers.

Geographical Factors

Geographical location plays a significant role in determining premiums. Some areas experience a higher frequency of claims, like urban regions located near accident-prone highways or neighborhoods with higher crime rates. Consequently, insurance companies may charge elevated premiums for residents in those areas due to increased risk assessments.

Environmental factors also contribute, as locations prone to natural disasters may face higher coverage expenses. Insurers reflect these risks in their pricing models, which can create disparities in premiums based solely on location. Understanding how geography influences personal **insurance** costs helps individuals anticipate potential rate adjustments.

Residents should be aware of insurance options specific to their regions, especially in dense urban environments. Local insurers might offer more competitive pricing compared to national companies, presenting opportunities for significant savings while covering unique risks inherent within certain locales.

Market Trends & Economic Factors

Market trends & economic factors also shape insurance premiums. Industries fluctuate based on unforeseen events whether regulatory changes, economic downturns, or emerging technologies. Insurance providers adapt to these trends by adjusting premiums as needed, ensuring their financial viability while addressing customer needs.

For example, when natural disasters strike & lead to increased claims, insurers often raise premiums across affected regions. Conversely, competition within the industry may create opportunities for customers to secure lower rates, prompting companies to become more transparent about pricing structures & policy features.

Individuals should stay informed about market developments that could impact premium calculations. Making educated decisions involves researching various providers’ offerings & identifying ways to maximize value without sacrificing coverage quality amid shifting industry dynamics.

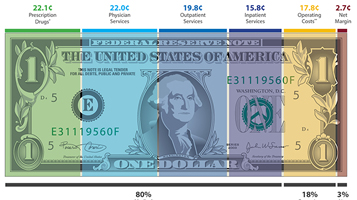

Where Do Insurance Premiums Go?

(1) Main Allocation of Premiums

- Claims Payments

- Administrative Expenses

- Investment Income

- Reserves for Future Claims

- Marketing & Advertising

Understanding Claims Payments

Claims payments constitute one of the most significant allocations of premiums. Insurers investigate claims meticulously before authorizing payouts, ensuring resources are managed prudently. These expenses form essential parts of insurance operations since policyholders expect reliable coverage & prompt assistance when issues arise.

Each claim processed influences premium calculations going forward; therefore, companies analyze historical data to predict future claims patterns. By employing actuaries, they can create accurate forecasts for long-term expenses associated with payouts. Consumers should appreciate this component when reviewing **insurance** cost breakdowns, recognizing that incurred claims strongly impact overall policy pricing.

Understanding claims payments allows policyholders to appreciate how premiums work beyond mere transactional exchanges. Engaging with insurance resources provides insights into valuable coverage while fostering a deeper recognition of their responsibilities as insured parties.

(2) Administrative Costs & Operating Expenses

- Salaries for Staff

- Technology Investments

- Office Space Maintenance

- Regulatory Compliance Costs

- Customer Service Operations

The Role of Investment Income

Investment income represents another crucial **component** of how premiums are utilized. Insurance companies invest policyholders’ premiums in various assets, including stocks, bonds, & real estate, generating additional revenue streams. This income helps offset operational expenses & allows insurers to maintain competitive premium prices.

Through these investments, insurance providers aim to grow their financial reserves, which ultimately contributes to lowering **insurance** rates for consumers. By understanding this aspect, policyholders can recognize how insurers mitigate risks while achieving profitability without burdening customers excessively.

Investment strategies adopted by companies reveal essential insights into their long-term financial health. Studying annual reports & market performance helps individuals select reputable insurers with sustainable business models, maximizing their investments concerning premiums paid over time.

Insurance Reserves Explained

Reserves are funds set aside by insurers to cover expected future claims. Insurers assess potential claims based on statistical analyses & claims history to calculate how much capital they need available. This allocation ensures that companies can maintain liquidity & secure sufficient resources for policyholders tapping into their benefits.

Understanding reserve management provides invaluable insight into how premiums work within insurance ecosystems. By ensuring adequate funding for anticipated losses, companies demonstrate their commitment to offering dependable service while minimizing risks associated with claim settlement.

Policyholders should feel empowered knowing that their premiums contribute directly towards securing future claims. This understanding enhances appreciation for overall coverage necessities, potentially leading individuals towards actively managing claims while ensuring compliance with all policy requirements as necessary.

(3) Funding Reserves for Future Claims

- Estimation of Future Liabilities

- Risk Management Strategies

- Financial Stability Assessments

- Monitoring Loss Trends

- Regulatory Requirements Compliance

Insurance Pricing Models

Insurance pricing models consider a plethora of factors influencing how premiums are structured. Insurers employ algorithms that weigh risks associated with each policyholder, resulting in price fluctuations based on individual characteristics. This comprehensive analysis reveals much about personal circumstances & their implications for overall **insurance** costs.

Different insurers may also utilize varying approaches, leading consumers towards potential discrepancies within premiums for similar coverage. This creates opportunities for comparison shopping among consumers seeking reasonable rates while maintaining robust coverage offerings.

Understanding pricing models empowers individuals by equipping them with knowledge about different policy options available. Familiarizing themselves with these complexities enables policyholders to make informed choices throughout their coverage journeys.

Market Regulations Impacting Premiums

Market regulations significantly influence insurance premiums across jurisdictions. Government agencies oversee industry practices & establish guidelines that dictate fair pricing, ensuring consumer protection. This regulatory framework prevents discriminatory pricing practices while fostering competition among insurers in various markets.

Understanding these regulations empowers consumers with critical insights about policy options available. Knowledgeable individuals can hold insurers accountable for providing reasonable rates consistent with established guidelines. Being proactive regarding local regulations allows policyholders greater security when negotiating premiums.

Individuals should seek further education on policies that govern their insurance landscape, including premium calculations & handling grievances effectively. Such awareness cultivates a sense of agency, ensuring consumers navigate complexities with confidence as they explore diverse offerings within an ever-evolving market.

(4) Regulatory Influences on Premium Pricing

- State Insurance Commissions

- Actuarial Standards Compliance

- Consumer Protection Laws

- Dispute Resolution Mechanisms

- Market Competition Effects

Understanding Deductibles, Copayments, & Coinsurance

Deductibles, copayments, & coinsurance represent cost-sharing mechanisms within various insurance policies. By understanding these features, policyholders can make informed choices while balancing their overall coverage needs with affordability. Analyzing terms regarding deductibles significantly impacts **insurance** costs & personal finances.

Deductibles refer to amounts policyholders must pay out-of-pocket before insurance coverage kicks in. Higher deductibles often result in lower premiums a trade-off policyholders need to evaluate closely. Understanding this relationship enhances decision-making around financial planning & healthcare access.

Copayments & coinsurance function similarly but apply post-deduction. Copayments entail fixed fees per service, while coinsurance breakdowns involve shared percentages of incurred costs. Exploring these components further illustrates complexities embedded within insurance pricing models, empowering individuals to understand how premium payments interact with overall coverage decisions.

Price Fluctuations & Rate Adjustments

Price fluctuations occur due to numerous factors including market trends, claims activity, & regional risks. As insurance companies adjust their pricing based on these influences, policyholders may experience rate changes that reflect broader market conditions. Staying informed about potential fluctuations empowers individuals when navigating their insurance journeys.

Rate adjustments typically arise after companies adjust premiums following significant market developments or unusual claims activity. Regular reviews of personal insurance policies facilitate better understanding of such adjustments, enabling timely interventions when needed to ensure adequate coverage without overextending financially.

Engagement with insurance agents can further assist individuals in obtaining clear explanations about pricing changes, fostering transparency throughout their ongoing relationships with insurers. Recognizing price fluctuations ensures policyholders advocate for their interests while adapting proactively as necessary.

Engaging with Insurance Companies

Engaging proactively with insurance companies allows individuals greater control over their insurance premiums. Open lines of communication foster trustworthy relationships, facilitating both parties’ understanding concerning premium calculations & service expectations. This engagement cultivates informed customers well-prepared for potential fluctuations or necessary policy adjustments.

Regularly reviewing policy details ensures that consumers are adequately informed about features like deductibles, coverage limits, & additional exclusions. Dicussions with agents bring clarity to complex terminologies while helping customers navigate their options in alignment with individual circumstances.

Being proactive regarding one’s policy reinforces essential partnerships with insurers motivated by shared interests. Understanding **premium** components significantly enhances relationships while ensuring overall satisfaction when engaging in coverage discussions.

Cost-Effective Solutions for Managing Premiums

Adopting cost-effective solutions helps individuals manage their insurance premiums efficiently. By identifying strategies that minimize overall expenses while maintaining coverage integrity, policyholders improve their experiences throughout the negotiation process. Seeking competitive quotes from multiple providers reinforces consumer priorities while ensuring favorable market conditions.

Risk management plays a crucial role in implementing cost-effective strategies. Individuals can improve personal risk profiles by incorporating safety measures such as home security systems, maintaining good credit, or following safe driving practices. Engaging with manufacturers offering bundling discounts may also reduce total costs significantly an opportunity worth exploring when evaluating comprehensive coverage options.

Understanding effective cost-saving strategies empowers policyholders with necessary tools for navigating changing market dynamics. By establishing well-informed practices conducive to minimizing overall premiums, individuals strengthen their financial positions while enjoying enhanced peace of mind concerning their **insurance** coverage.

(5) Smart Approaches for Premium Management

- Regular Policy Reviews

- Bundling Multiple Coverages

- Incorporating Risk Management Strategies

- Seeking Competitive Quotes

- Understanding Discounts Offered

| Insurance Type | Common Premium Adjustments | Estimated Savings |

|---|---|---|

| Auto Insurance | Safe Driving Discounts | Up to 20% |

| Home Insurance | Bundling Savings | Up to 15% |

| Health Insurance | Wellness Program Discounts | Varies |

| Factor | Impact on Premiums | Potential Benefit |

|---|---|---|

| Credit Score | Higher Score = Lower Premium | Long-term Savings |

| Claims History | More Claims = Higher Premium | Lower Rates After Clean History |

| Age & Experience | Older Drivers = Lower Premium | Savings with Safe Driving |

“Understanding where your **insurance premiums** go empowers you in navigating coverage options with informed insight.”

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png)

Conclusion

Understanding where your insurance premiums go can help you feel more confident in your coverage. Your hard-earned money doesn’t just vanish; it funds important services like claims handling, customer support, & administrative costs. Insurance also contributes to the larger pool that pays for unforeseen events. Remember, while shopping around for the best insurance costs is wise, it’s equally important to read the fine print & understand what you’re paying for. Take the time to ask questions & clarify anything unclear. After all, an informed policyholder is a happier one! Stay savvy about your insurance expenses!