To make insurance cheaper, consider bundling policies, maintaining a good credit score, increasing deductibles, & shopping around for quotes regularly. Utilize available discounts for safe driving, loyalty, or group memberships. And another thing, review your coverage needs periodically to eliminate unnecessary extras, & consider switching to pay-per-mile auto insurance if you drive less. Taking a defensive driving course can also lead to further discounts. Lastly, stay informed about any changes to your policies & negotiate with your insurer for better rates.

How to Make Insurance Cheaper: 10 Proven Strategies to Save Money. Discover how to make insurance cheaper with these 10 proven strategies! Save money effortlessly with our easy tips for smarter insurance choices.

Understanding Your Insurance Policy

One key aspect of making insurance cheaper revolves around understanding specific details of your policy. Having a clear grasp on terms, coverages, exclusions, & conditions can greatly influence your ability to save money. By being knowledgeable about what your policy entails, you’re less likely to overpay for unnecessary coverage.

And another thing, many consumers unknowingly accept policies that provide excessive coverage which may not fit their needs. Conducting a thorough review of current policy allows for identification of areas where savings can occur. This strategic evaluation prepares you to make educated decisions regarding any potential adjustments or changes that may be made.

Take advantage of available online resources, customer support, & financial advisors when necessary. Understanding how your policy operates can lead you towards significant savings opportunities that may have otherwise gone unnoticed.

Shopping Around for Better Quotes

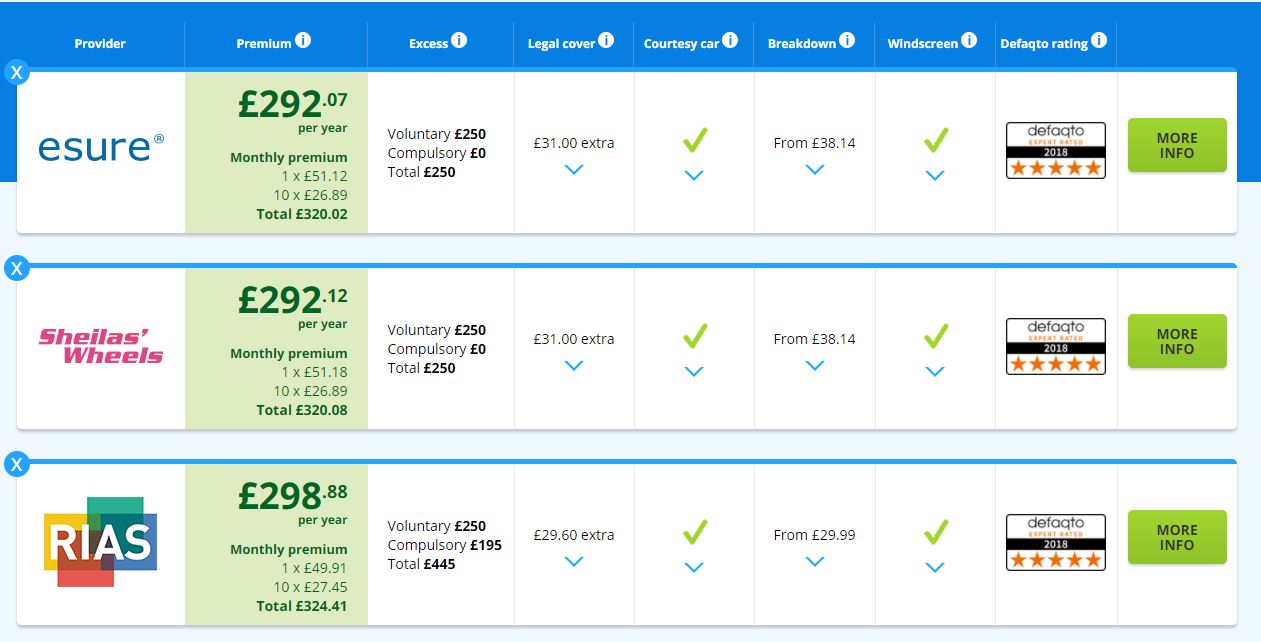

Remaining diligent while searching for insurance policies offers potential savings. Various companies provide differing rates for similar coverage levels. By gathering multiple quotes from various providers, consumers can determine which options suit their budgets best. Each time you switch providers, you may uncover better rates or improved coverage.

Take care not only focus on price, Be that as it may. Consider factors such as customer service quality, claim processing times, & overall satisfaction from existing clients. A lower rate from one insurance provider may come at a cost associated with reduced service quality.

Utilizing online comparison tools simplifies this process. These platforms allow easy side-by-side comparisons among multiple insurance providers, ensuring consumers find best deal suited to their specific requirements.

Bundling Insurance Policies

Bundling insurance policies can often lead to significant overall savings. Many insurance companies provide discounts for customers who choose to bundle multiple policies, such as automobile, homeowner, or renter’s insurance. By insuring multiple needs with one provider, customers frequently enjoy reduced premiums.

And another thing, creating a unified account with one insurer can streamline payments & claims processes. This simplification saves time & reduces headaches associated with managing multiple policies across different companies.

While exploring bundling options, ensure proper coverage remains intact. Stay vigilant regarding each individual policy’s terms to avoid any gaps in coverage that may arise from adjustments made during bundling.

Increasing Your Deductible

A potentially effective method of making insurance cheaper involves increasing your deductible. A deductible represents amount you must pay out-of-pocket before your insurance kicks in. Typically, selecting a higher deductible results in lower premium payments.

This strategy proves most beneficial for those who possess a strong financial cushion or have minimal past claims. Be that as it may, carefully consider potential out-of-pocket expenses before opting for a higher deductible as this choice requires preparedness for sudden unexpected costs.

Always assess your personal situation regarding your financial capabilities. Increasing your deductible could yield immediate savings, but ensure you remain comfortable with your choice aware of risks associated with higher financial responsibility.

Maintaining a Good Credit Score

Interestingly, many insurance providers take into account your credit score when determining premiums. A higher credit score correlates with lower risk from an insurer’s perspective. Therefore, maintaining good credit can lead directly to cheaper premiums over time.

Focus on making timely payments, reducing outstanding debts, & controlling credit utilization ratios. These actions contribute towards improving your credit score. Periodically review your credit report for accuracy & address any discrepancies that may mistakenly lower your score.

An improved credit score might not provide immediate reductions in premiums, but over time, this can significantly affect your potential savings across various types of insurance.

Taking Advantage of Discounts

Many insurance companies offer a variety of discounts which may slip past your notice. Investigate available discounts related to automobile safety features, homeowner security systems, & even professional affiliations or memberships. By accessing these discounts, you can effectively lower your overall insurance costs.

In addition, consider whether you qualify for discounts based on factors such as customer loyalty or multi-policy discounts. Each insurer operates differently, so be proactive when communicating with your provider & asking about potential discounts.

Keep all pertinent documentation ready which substantiates any claims for discounts. Following up on these inquiries ensures maximized savings opportunities based on unique attributes or situations relating to your insurance needs.

Reviewing Your Coverage Regularly

Regularly reviewing your coverage helps identify any unnecessary expenditures & assists in optimizing your insurance policies. Life circumstances may change over time that affect your insurance needs. Adjusting your coverage aligns your policy with current life events, ensuring you utilize only necessary protection.

By analyzing policy details annually (or sooner if significant changes occur), identify areas where savings may arise. For instance, if you’ve paid off a loan or sold a vehicle, consider reducing relevant coverage levels.

On top of that, remaining updated on policy changes & market trends allows you to stay informed about potential opportunities for adjusting your premiums. Ensuring proactive monitoring can lead towards identifying suitable areas for cost reduction.

Utilizing Annual Mileage Discounts

For drivers, reporting annual mileage may present opportunities for discounts on car insurance. If accustomed to driving less or utilizing alternative transportation methods, communicate this information with your insurer. Many providers offer discounts for lower annual mileage, recognizing decreased risk associated with infrequent driving.

If your daily routine has shifted or you’ve resolved to spend less time on the road, document this change with accuracy. Some insurers may even provide telematics-based programs tracking your driving behavior, which also could yield further savings.

Ultimately, encouraging responsible driving contributes towards safer roadways & offers both individuals & society improved financial benefits.

Being Cautious with Claims

While making a claim might offer immediate relief during a crisis, ensure vigilance regarding how often you make these claims. Frequent claims can prompt insurers to raise your premium rates as they view you as a higher-risk client.

Instead, weigh the options carefully each time a claim arises. If damages are manageable within your budget, consider covering them out-of-pocket without utilizing your insurance policy. This approach maintains your premium rates while protecting you from future potential increases.

Remember that each claim carries unique consequences when it comes to insurance premiums. Maintain awareness of your claims history & understand how even minor claims can impact your costs long-term.

Exploring Nonstandard Insurance Options

Traditional insurance may not always provide the best rates for individual situations. Nonstandard insurance options might warrant consideration. These policies cater primarily to individuals experiencing challenges obtaining standard coverage or who possess unique insurance requirements.

While exploring less conventional offerings, remain diligent about thoroughly evaluating these policies. Read through terms, conditions, & opportunities presented by nonstandard providers. Sometimes, niche insurers offer better tailored solutions meeting specific needs, potentially leading to improved savings.

Be that as it may, here again, making informed choices extends beyond mere pricing. Compare various providers, assessing coverage differences, & ensure any options pursued align accordingly.

| Strategy | Expected Savings | Notes |

|---|---|---|

| Understanding Your Policy | Varies | Knowledge helps avoid unnecessary coverage. |

| Shopping Around | 5%-30% | Comparing quotes fosters competitive options. |

| Bundling Policies | 10%-25% | Single provider simplifies account management. |

“Focusing attention on individual circumstances can reveal surprising savings in insurance policies.”

Analyzing Financial Implications of Policy Changes

Adverse financial repercussions may arise following adjustments made to your insurance policies. Before tampering with coverage levels, thoroughly assess short- & long-term implications of any changes intended. Understand potential risks involved while making such alterations.

While saving money remains essential, acquiring adequate coverage remains equally critical. Analyzing financial implications serves as an integral component of overall strategy, balancing saving while safeguarding personal assets.

Encouraging discussions with financial advisors, insurance agents, or fellow consumers who share positive experiences helps clarify specific strategies & their associated ramifications. Build knowledge around various nuances shaping insurance market dynamics towards achieving balance.

| Financial Aspect | Short-Term Effect | Long-Term Effect |

|---|---|---|

| Increased Deductible | Lower premiums | Potential higher out-of-pocket costs |

| Fewer Claims | Slight decrease in premiums | Potential for substantial savings over time |

| Improving Credit Score | May require initial effort | Long-lasting reduced premium costs |

In my own experience, utilizing some of these strategies dramatically reduced my insurance costs. After shopping around & bundling my policies, I managed to save nearly 30%. This approach not only provided me with financial relief but also reassured me regarding the adequacy of my coverage.

Understanding Local Regulations & Market Trends

Exploring local regulations surrounding insurance may reveal opportunities for savings. Each state or region might impose different requirements positively or negatively impacting premiums. Understanding these regulations helps you navigate best options available.

And another thing, remaining updated on market trends allows consumers greater control over their insurance choices. Companies may adjust pricing strategies based on economic circumstances or consumer behavior, presenting potential areas where better rates may emerge.

Engage actively within your community or connect with local financial groups dedicated to discussing insurance matters. Banding together with others forms a network where shared knowledge ultimately leads towards improved decision-making on behalf of individual local consumers.

Reviewing Claims History

Being mindful of your claims history becomes essential when evaluating insurance rates. Insurers typically analyze past claims to establish risks associated with insuring you as an individual. A history of frequent claims might lead to higher premiums dictated by perceived higher risks.

Focusing on proactive measures such as loss prevention or risk management can minimize claims over time. When circumstances allow yourself, make decisions that preserve your claims record as best you can. Over time, this effort typically reduces premium costs through better assessment by insurers.

And don’t forget, obtaining a copy of your claims history allows transparency, enabling potential discussions with insurers regarding improving premium rates based on your clean claims history.

Conclusion

In conclusion, saving on insurance doesn’t have to be complicated. By implementing these 10 proven strategies, you can easily make your insurance cheaper. Don’t forget to shop around, bundle policies, & maintain a good credit score. Also, consider raising your deductible & asking for discounts. It’s important to regularly review your coverage & stay informed about new offers. Each small change can lead to significant savings. Remember, it’s your money, so take the time to ensure you’re not overpaying. Start applying these tips today & watch your insurance costs drop!